Several weeks ago my annual legislative report was mailed out to constituents in the 26th District. Since then I have heard from many of you. Some have asked questions, while others have expressed their views, hopes or concerns for the upcoming 2018 Legislative Session, which starts in January. One of the most frequently asked questions: What is the difference between general revenue funds and the total budget?

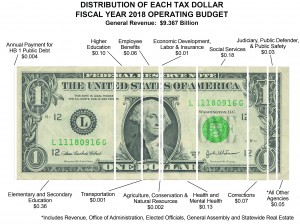

General revenue is the monies received at the state and local levels of government that can be used for any purposes. These unallocated funds are received through business, personal and property taxes. Since the funds are not directed, the state may use the funds in most any way it sees fit through the appropriations process we go through every session. For example, education appropriations make up a greater proportion of the general revenue dollars than of the total budget because the legislature prioritizes education with state money but many federal funds go to social services. General Revenue funds are allocated by lawmakers and then approved by the governor in his final budget.

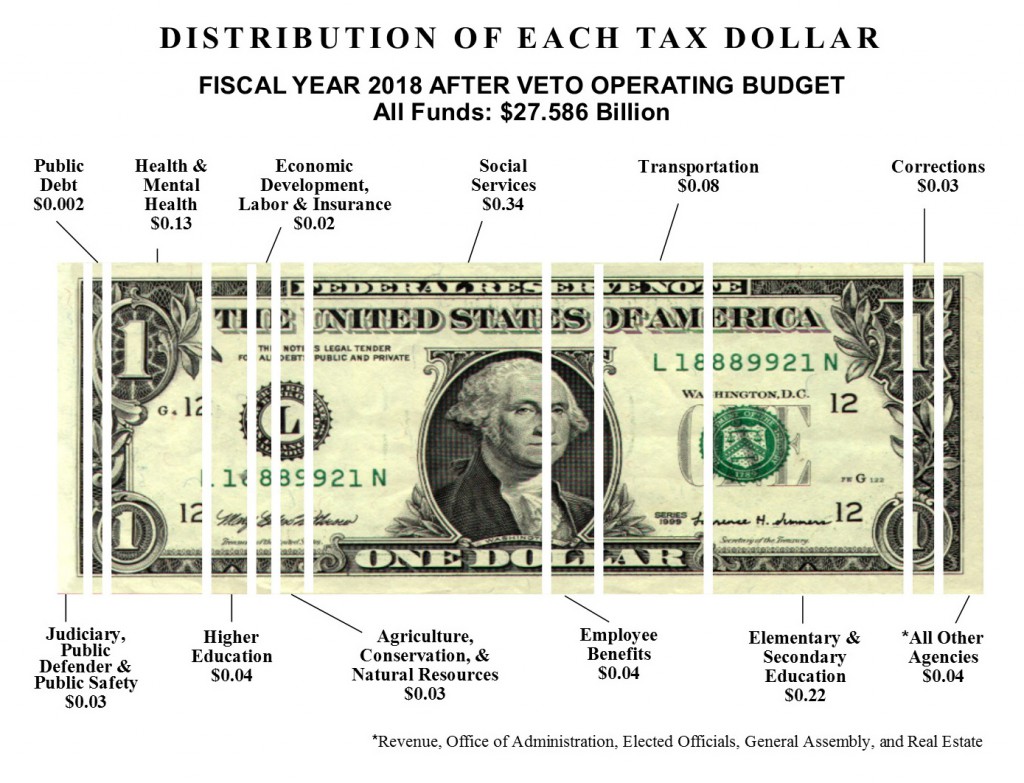

Federal funds that Missouri receives are counted toward the total budget. Federal funds are given to Missouri through grants and to also help administer federally based programs like Medicaid. When these monies are given to Missouri they are earmarked for a specific purpose.

The same is true for certain state funds. Funds like revenues from the state fuel tax are dedicated to transportation and must be spent on transportation issues. Both state and federal funds must be used as directed by law. It is general revenue monies that the lawmakers allocate every year in our state budget. For fiscal year 2018 there was $9.367 billion in general revenue out of the state’s $26.8 total billion budget.

Thank you for reading this weekly column. Please contact my office at (573) 751-3678 if you have any questions.