Protecting Small Business

The past year has been tough for business, and the future remains uncertain as COVID-19 continues to impact our communities. Although each business does its best to mitigate risks and protect staff and customers, there’s always a chance that someone will find fault, and try to hold businesses and their owners accountable for things beyond their control. This week, the Missouri Senate took a major step toward protecting our state’s small businesses. Senate Bill 51, a measure which shields small businesses, health care providers, manufacturers and churches from lawsuits related to COVID-19, received initial approval. One vote remains in the Senate before the bill moves to the House of Representatives for its consideration.

The legislation protects businesses from pandemic-related lawsuits unless the defendant acted recklessly or engaged in willful misconduct. The same standard also applies to health care facilities and certain manufacturers – especially those who stepped outside the normal scope of their business to help meet demand for personal protective equipment and medical supplies. During a 15-hour deliberation on the Senate floor, an amendment was added to protect churches from COVID-19 lawsuits, except in cases of intentional misconduct.

Prior to our debate in the Senate chamber, I heard from a number of constituents who expressed reservations about this legislation. Frankly, I believe many of the people who called and emailed my office had received some erroneous information. There are a number of misconceptions that should be addressed. First, this bill does not protect bad actors. Those who acted recklessly can still be held accountable. Also, this legislation does not require anyone to be vaccinated. In fact, it specifically says the law does not mandate vaccinations. Finally, a number of people have asked how SB 51 changes existing laws or eliminates the right of plaintiffs to sue about other matters. I can assure you this bill is narrowly drafted to only address COVID-19 issues. It doesn’t upend Missouri’s current law.

Is the bill perfect? Probably not. But I support this legislation in its current form. I believe it walks the line between allowing people who have legitimately suffered harm to have their day in court, while protecting small businesses from meritless lawsuits. I was especially glad to see protections were added for churches and pastors who continue to shepherd their flocks during these troubling times. As Missouri’s economy begins to recover from the coronavirus pandemic, small businesses need to know they won’t have to face an endless string of lawsuits. This legislation provides Missouri employers that confidence and helps the state move beyond COVID-19.

Also this week, I presented Senate Bill 96 to the Agriculture Committee. This legislation creates the Missouri Made Fuels Act and establishes a minimum biodiesel standard in our state. Missouri is the No. 3 supplier of biodiesel in the United States, with nearly 250 million gallons of plant-based fuel produced each year. Biodiesel, made from soybeans, contributes to more than 3,200 Missouri jobs and adds $1.7 billion each year to the state’s economy, according to the Missouri Soybean Association. Despite this, there is no requirement that any of this Missouri-made energy is consumed here at home. My legislation phases in a minimum biodiesel standard, beginning with a 5% biodiesel blend and eventually reaching 20% by 2024. The blend requirement would be seasonally adjusted, with a lower percentage in colder months. Passage of this legislation would increase demand for Missouri soybeans and bring additional revenue to our state. This is in addition to the advantages of the fuel itself, which include lower hydrocarbon emissions, increased lubricity and reduced dependence on foreign oil.

In other legislative activity, the Senate Appropriations Committee continued its work hearing budget requests from the various state agencies and departments. This process will go on for a number of weeks as the committee considers spending requests from the departments, as well as from the governor, and begins to prepare a Senate budget recommendation for Fiscal Year 2022. This week’s hearings focused on the state’s public debt and the budgets of the Departments of Corrections and the Office of Administration. A hearing for the departments of Commerce and Insurance and Labor and Industrial Relations had to be rescheduled due to overnight deliberations on Senate Bill 51, which concluded at 5 o’clock Wednesday morning.

The Appropriations Committee also heard testimony on two sports wagering bills. Both of these bills are alternatives to legislation I put forward this year, Senate Bill 18 and Senate Bill 98, a comprehensive gaming bill I presented to the committee last week. The two bills presented this week would both return far less money to the state from casinos and gaming companies than the legislation I proposed. My bills are more consistent with the percentages paid to neighboring states, and would result in much greater revenue to support elementary and secondary education. During the hearing this week, I pressed gaming industry representatives to explain why we should give “the house” a larger share of the stake than other states. I see no reason to leave money on the table, so I will continue to advocate for the gaming measures I’ve introduced.

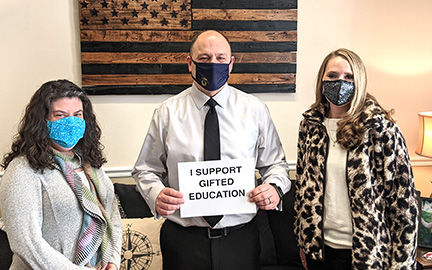

Although COVID-19 has reduced the number of visitors to the State Capitol, we continue to meet with constituents in our office. This week, I had the pleasure of welcoming Meredith Wisniewski and Heather Tomicich, who visited on behalf of the Gifted Association of Missouri. The two educators were here to discuss my Senate Bill 151, which expands specialized programs for gifted students.

As always, I appreciate hearing your comments, opinions and concerns. Please feel free to contact me in Jefferson City at (573) 751-4302. You may also email me at denny.hoskins@senate.mo.gov.