For Immediate Release: Feb. 28, 2025 Contact Jaret Scharnhorst: 573-751-1492 | | Capitol Building, Room 331-A Jefferson City, MO 65101 |

Utilities Bill Passed by the Senate It was another productive week in the Missouri Senate. On Feb. 24, the Senate passed Senate Bill 4 to modernize outdated utility regulations, prevent power outages and strengthen Missouri's energy infrastructure. Senate Bill 4 contains language from a number of related utilities bills, past and present, including: - Senate Bill 1219: Protects a handful of older, small solar generation facilities in Missouri that built and sold power under “law of the land” at the time, which was zero property tax. The “grandfathering” language still allows the county to collect a small tax, but prevents these projects from going bankrupt.

- Senate Bill 1470: Repeals certain provisions relating to maximum penalties for violations of federally mandated natural gas safety standards and provides that the maximum penalties shall not exceed federal penalties.

- In regard to Public Service Commission (PSC) assessment provisions, SB 4 raises the cap from 0.035 to 0.05 for additional staff.

- Senate Bill 4 increases Office of Public Counsel (OPC) funding from $2 million to $5 million, with added duties in order to better protect consumers.

- Senate Bill 491: Ensures that utilities provide an open-access option for vendors to execute energy efficiency programs, and allows the PSC to investigate complaints regarding violations of this section.

- In regard to hot weather rules, SB 4 changes the 24-hour notice of shut off for non-payments to 72 hours to protect consumers.

- Senate Bill 4 requires the utility to file a plan with the PSC to ensure that large electricity users pay their fair share.

- Senate Bill 186: Enacts Construction Work in Progress (CWIP), an accounting tool that allows utilities to recover some costs of new construction projects, such as generating facilities, while the project is still under construction. When this is allowed, it means utilities can start earning a return on investment in these projects before they are completed. This section will allow CWIP to be included in rates for the construction of any new gas-generating unit. It also serves as a carve-out to a statutory prohibition on the inclusion of CWIP in utility rates through the proposed Integrated Resource Plan reform. The second provision relates to the state’s reliability mechanism. Due to the closure of coal plants and the intermittent reliability of renewable resources, there is a need to ensure that Missouri has adequate and dependable energy resources available.

- Senate Bill 1280: Allows water, sewer and gas regulated utilities the option of filing rate cases based on a future test year. Currently, Missouri's process only permits the use of a historical test period to set prospective rates. Utilizing a future test year would benefit customers by involving all interested parties such as the PSC, the OPC and other consumer groups in the evaluation of capital projects and expenditures before they occur.

- Senate Bill 741: Clarifies the definition of a large public utility. The statute defines a large water public utility using a threshold of 8,000 customer connections. There is some ambiguity regarding whether the threshold counts water and wastewater connections combined or separately. This makes it 8,000 water, wastewater or combined water/wastewater customers. The second section provides clarity to the sale and processes when a utility is acquiring a small water system.

- Senate Bill 757: Requires a utility to have reliable, dispatchable power available before retiring a power plant.

- Senate Bill 1422: Allows large energy consumers to purchase renewable energy credits from the market, preventing them from being charged twice – once for the credits they buy and again for the utility’s renewable compliance costs;

- House Bill 1746: Includes a provision relating to discounts by gas corporations, when the customer is new, and the projected new load is expected to be at least 270,000 CCF (Centum Cubic Feet) of gas annually, the corporations may offer a 25% discount on fixed costs for 4 years.

- Also included in SB 4 is my smart meter legislation, Senate Bill 224. My added provisions allow utility customers to choose a traditional meter instead of a smart meter. Reliable and affordable energy is a necessity for every household. Utility companies should serve the interests of hardworking Missourians, not the other way around. This legislation puts families in control of their energy choices.

Other bills that were third read and passed this week include: - Senate Bill 757: Requires a utility to have reliable, dispatchable power available before retiring a power plant.

- Senate Bill 22, which I co-sponsored, reworks how ballot issue summaries are written and prevents judges from rewriting ballot summaries sent to voters.

- Senate Bill 68: Prohibits student cell phone usage during the school day except for instructional purposes or emergencies.

- Senate Bill 63: Ensures home school students have the right to participate in public school sports or activities.

- Senate Bill 10: Eliminates a large and varied number of sunset provisions in state statute. Sunsets are automatic repeals of various provisions of the law, including tax credits, that have limited return on investment for Missouri taxpayers.

REINing in Bureaucratic Overreach Unelected bureaucrats should not be able to impose costly regulations without legislative approval. On Feb. 24, a hearing was conducted in the Senate Government Efficiency Committee for Senate Bill 350, Missouri’s version of the REINS Act. This bill would require any proposed regulations submitted by state agencies that would result in the expenditure of public funds or a reduction in state revenue greater than $250,000 to be approved by the General Assembly. By guaranteeing that elected lawmakers have the final say on expensive or revenue-draining regulations, we can ensure that accountability remains firmly in the hands of the people’s representatives.  Exempting Groceries and Diapers from Sales Tax Exempting Groceries and Diapers from Sales Tax

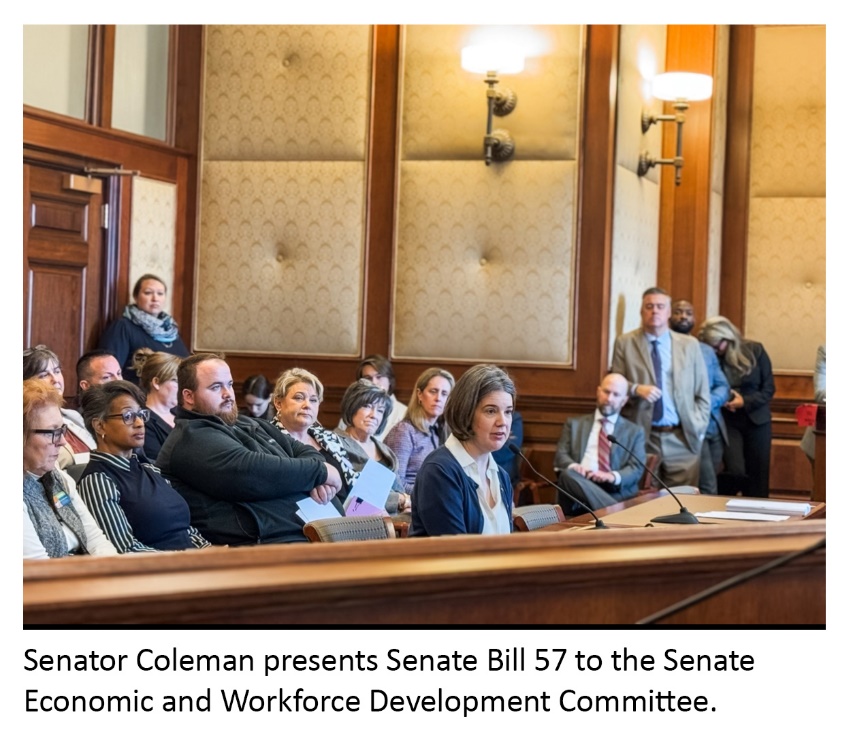

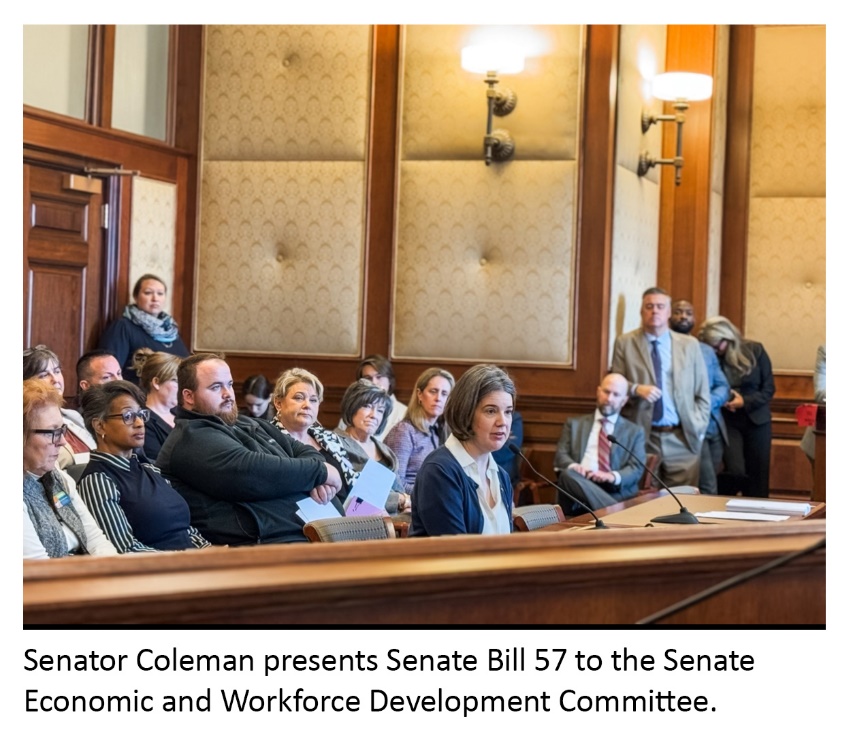

On Feb. 26, I presented Senate Bill 57 to the Senate Economic and Workforce Development Committee. For reasons that escape me, groceries continue to be taxed at varying rates across the state and diapers are taxed at the luxury tax rate. While we must have funding for essential services in Missouri, we cannot continue to do so through a regressive tax system that is built on the backs of the poor. For years, I have filed bills to exempt groceries and diapers from state sales tax and bring us in line with the 42 other states that exempt these items from higher sales tax rates.

|